Rental DSCR loans

A Rental DSCR Loan is a type of real estate financing designed for investors who own or plan to purchase rental properties. Unlike traditional loans, which focus on the borrower’s income and creditworthiness, DSCR loans primarily evaluate the property’s cash flow.

The Debt Service Coverage Ratio (DSCR) measures a property’s ability to cover its debt obligations (loan payments) with its rental income. This makes DSCR loans ideal for real estate investors who rely on rental income rather than personal income to qualify for loans.

Key Features of Rental DSCR Loans

- Qualification Based on Property Cash Flow: Borrower’s personal income is not a primary factor; the property’s cash flow is what matters most.

- Flexible Credit Requirements: Credit score minimums vary but are generally less stringent than traditional loans.

- No Tax Returns or W-2s Required: Borrowers don’t need to provide proof of personal income, making it ideal for self-employed individuals and investors.

- Loan-to-Value (LTV) Ratios: Typically up to 75-80% for purchases and refinances.

- Interest Rates: Slightly higher than traditional loans due to the property-centric risk assessment.

- Loan Amounts: Ranges from $100,000 to $5 million or more, depending on the lender.

- Property Types Eligible: Single-family homes, condos, townhomes, and multi-unit properties (usually up to 4 units).

- Prepayment Penalties: Often included for the first few years of the loan, as these loans are intended for long-term investments.

How Does DSCR Work?

DSCR is calculated using the following formula:

DSCR = Net Operating Income (NOI) ÷ Total Debt Service

- Net Operating Income (NOI): Total rental income minus operating expenses (e.g., taxes, insurance, maintenance, property management fees).

- Total Debt Service: The total annual loan payment (principal + interest).

For example:

- Rental income: $3,000/month ($36,000/year)

- Operating expenses: $1,000/month ($12,000/year)

- NOI: $24,000/year

- Annual loan payment: $20,000/year

- DSCR = $24,000 ÷ $20,000 = 1.2

A DSCR greater than 1.0 means the property generates enough income to cover its debt obligations, while a ratio below 1.0 indicates a shortfall.

- Dedicated Client Support

- Competitive Rates & Terms

- Tailored Financial Solutions

- Fast & Easy Application Process

- Access to a Broad Lender Network

- Financial Expertise You Can Trust

Pros and Cons of Rental DSCR Loans

Pros

- Simplified Qualification: No personal income verification required.

- Focus on Rental Cash Flow: Emphasis on property performance makes it accessible to investors.

- Faster Approval Process: Reduced documentation requirements speed up processing.

- Ideal for Portfolio Growth: Supports scalability for real estate investors.

Cons

- Higher Interest Rates: Rates are generally higher than traditional loans.

- Prepayment Penalties: May incur fees for paying off the loan early.

- Higher Down Payment Requirements: Lenders may require 20-25% down for purchases.

- Cash Flow Risks: If rental income decreases, the property may struggle to meet DSCR requirements.

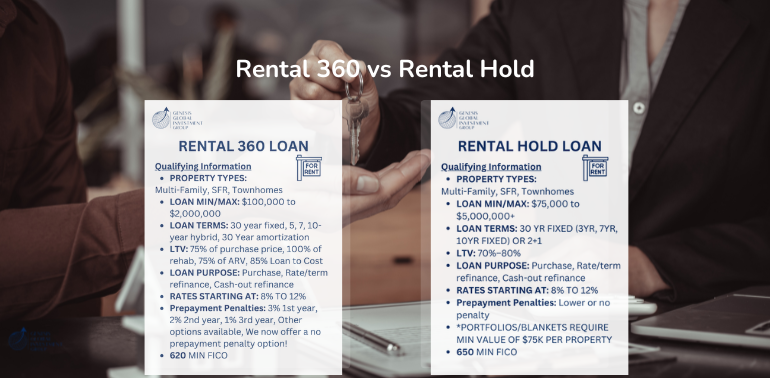

Two Types of DSCR Loans: Rental 360 vs. Rental Hold

Debt-Service Coverage Ratio (DSCR) loans are designed for real estate investors who want financing based on rental income rather than personal income. Two popular DSCR loan options are Rental 360 and Rental Hold. Both cater to rental property investors but differ in terms, flexibility, and long-term benefits.

1. Rental 360 Loan (Traditional Long-Term DSCR Loan)

Key Benefit:

Long-term financing stability with a 30-year loan term, making it ideal for buy-and-hold investors focused on consistent rental income and property appreciation.

2. Rental Hold Loan (Short-Term, Flexible DSCR Loan)

Key Benefit:

Shorter loan term with flexible exit options, making it ideal for investors who plan to refinance, sell, or transition properties within a few years.

Which One Is Right for You?

| Feature | Rental 360 (Long-Term) | Rental Hold (Short-Term) |

|---|---|---|

| Best for | Buy-and-hold investors | Short-term investors |

| Loan Term | 30 year fixed, 5, 7, 10-year hybrid, 30 Year amortization (fixed/adjustable) | 30yr Fixed (3yr, 7yr 10yr Fixed) OR 2+1 (interest-only options) |

| DSCR Requirement | 1.0–1.25 | 1.0–1.25 |

| LTV (Max.) | 85% purchase/refi, 75% cash-out | 70%–80% |

| Prepayment Penalty | 3% 1st year, 2% 2nd year, 1% 3rd year, | Lower or no penalty |

| Property Types | SFR, multifamily, mixed-use | SFR, multifamily, mixed-use |

| Closing Time | 21–45 days | 15–30 days |

| Exit Strategy | Long-term hold | Refinance, sell, or reposition property |

Final Thought:

Choose Rental 360 if you want long-term stability, predictable payments, and cash flow-focused financing.

Choose Rental Hold if you need flexibility for short-term strategies like repositioning, refinancing, or selling properties.

We specialize in Rental DSCR Loans financing across all 49 states. Our competitive rates, flexible terms, and quick approval process are designed to help you succeed. Whether you’re a seasoned investor or new to the market, we’ll work with you to structure a loan that fits your project’s unique requirements.

Contact Us Today Ready to fund your next Bridge Loan? Reach out to Genesis Global Investment Group for expert guidance and fast funding. We’re here to help you maximize your investment potential! Apply Now

Rental DSCR FAQ's

What DSCR do lenders usually require?

Most lenders require a DSCR of at least 1.0, meaning the rental income must cover the property’s debt payments. Some lenders may prefer a DSCR of 1.25 for added cushion.

Types of Properties Eligible for Rental DSCR Loans

1. Single-Family Homes (SFRs)

Description: Standalone residential properties rented to a single tenant or household.

Why It Qualifies: Single-family homes are popular among real estate investors for their consistent demand and easier management.

Examples: Suburban houses, urban rental homes.

2. Multi-Family Properties

Description: Residential buildings with multiple units, typically ranging from 2 to 4 units.

Why It Qualifies: Multi-family properties generate multiple streams of rental income, reducing risk.

Examples: Duplexes, triplexes, quadplexes.

3. Condominiums

Description: Individually owned units in a shared building or complex.

Why It Qualifies: Condos are often purchased for long-term or short-term rental opportunities.

Considerations: Some lenders may require HOA approval or additional due diligence on the condo association.

4. Townhomes

Description: Attached residential properties, typically sharing walls with adjacent units.

Why It Qualifies: Townhomes are affordable investments with high rental appeal, especially in growing urban areas.

5. Short-Term Rentals (STRs)

Description: Properties rented for short durations, often on platforms like Airbnb or VRBO.

Why It Qualifies: STRs can yield high income, but lenders may require proof of rental income or market rent estimates.

Examples: Vacation homes, city apartments.

6. Small Apartment Buildings

Description: Multi-family properties with 5+ units but still considered smaller than large apartment complexes.

Why It Qualifies: These properties produce higher rental income and are attractive for scaling investment portfolios.

7. Mixed-Use Properties

Description: Buildings combining residential and commercial spaces.

Why It Qualifies: Eligible if the residential component generates sufficient rental income (e.g., apartments above retail shops).

Considerations: Some lenders may limit the commercial space to a percentage of the total building area (e.g., ≤25%-50%).

8. Portfolios of Rental Properties

Description: A collection of multiple rental properties, often financed together under one loan.

Why It Qualifies: Portfolio loans streamline the financing process for investors managing multiple properties.

9. Manufactured Homes

Description: Prefabricated homes installed on permanent foundations and titled as real property.

Why It Qualifies: Eligible if the home is in a stable rental market and meets lender requirements for age and condition.

10. Vacation Homes

Description: Second homes are rented out seasonally to vacationers.

Why It Qualifies: Can qualify if the property demonstrates strong seasonal rental income potential.

11. Student Housing

Description: Properties located near colleges or universities rented to students.

Why It Qualifies: Demand remains consistent in areas with high student populations.

What Properties May Require Special Consideration?

While most income-generating properties qualify, the following may need additional review or conditions:

- Properties in Rural Areas: May require market rent evaluations to confirm demand.

- Non-Traditional Properties: Converted homes, tiny homes, or unique properties may require additional appraisals or alternative documentation.

- Distressed Properties: Eligible if they will be stabilized and generate income post-renovation (often combined with a Rental Hold Loan).

What Type of Property Does Not Qualify for Rental DSCR Loans?

Rental DSCR loans are for investment purposes only, meaning the following are typically ineligible:

- Owner-Occupied Properties: Not allowed, as DSCR loans focus on rental income.

- Vacant Land: Requires construction or development financing.

- Properties Without Income Potential: Lenders require proof of current or market rent.

Can I use projected rental income if the property is not yet rented?

Yes, lenders can use market rent estimates from a property appraisal report to calculate DSCR, even if the property is vacant.

Are there prepayment penalties?

Many DSCR loans include prepayment penalties, 3% 1st year, 2% 2nd year, 1% 3rd year, Other options available, We now offer a no prepayment penalty option! The specifics depend on the lender and loan terms. Contact us for more info!

What is the interest rate on a loan?

The interest rates for Rental DSCR Loans typically fall within a range of 8% to 12%, depending on several factors. These rates are generally higher than those for conventional mortgages because DSCR loans are considered riskier due to their reliance on property cash flow rather than the borrower’s personal income

Can I use DSCR loans for short-term rental properties like Airbnb?

Yes, many lenders allow DSCR loans for short-term rentals. However, they may require proof of income from platforms like Airbnb or use market rent estimates for underwriting.

Can I refinance an existing loan with a DSCR loan?

Yes, DSCR loans can be used for rate-and-term refinances or cash-out refinances. Cash-out refinances may have stricter DSCR and LTV requirements.

Do I need landlord experience to qualify?

Not always. While some lenders prefer borrowers with experience managing rental properties, others are willing to work with first-time investors.

How do operating expenses affect DSCR calculations?

Operating expenses (e.g., taxes, insurance, HOA fees) reduce the net operating income (NOI), which can lower your DSCR. Keeping expenses low can improve your chances of qualifying.

What happens if my DSCR is below 1.0?

If your DSCR is below 1.0, lenders may offer alternatives such as a lower loan amount, higher interest rates, or requiring additional reserves.

Are DSCR loans available in all 49 states?

Yes, most lenders offering DSCR loans operate nationwide, but availability may vary by state and lender.

What happens if my rental income decreases after getting the loan?

Once approved, rental income changes won’t typically affect your existing loan. However, if you plan to refinance or apply for additional DSCR loans, your new cash flow situation may impact future approvals.

%

Rates as low as 8% to 12%

$ K

Loans from $75K to $5M+

%

No DSCR option available with 75% LTV at slightly higher rates.

YR

5, 7, 10-year hybrid, 30 Year amortization

GGIG Commercial Loan Mortgage Calculator

Your Results:

Save results:

| Period | Date Payment | Opening Balance | Monthly Principal | Monthly Interest | Closing Balance |

|---|